A further economic setback has befallen the Biden-Harris government.

Worries that a recession may be on the horizon were fueled by an unexpected increase in the US unemployment rate and a slowdown in job increases last month.

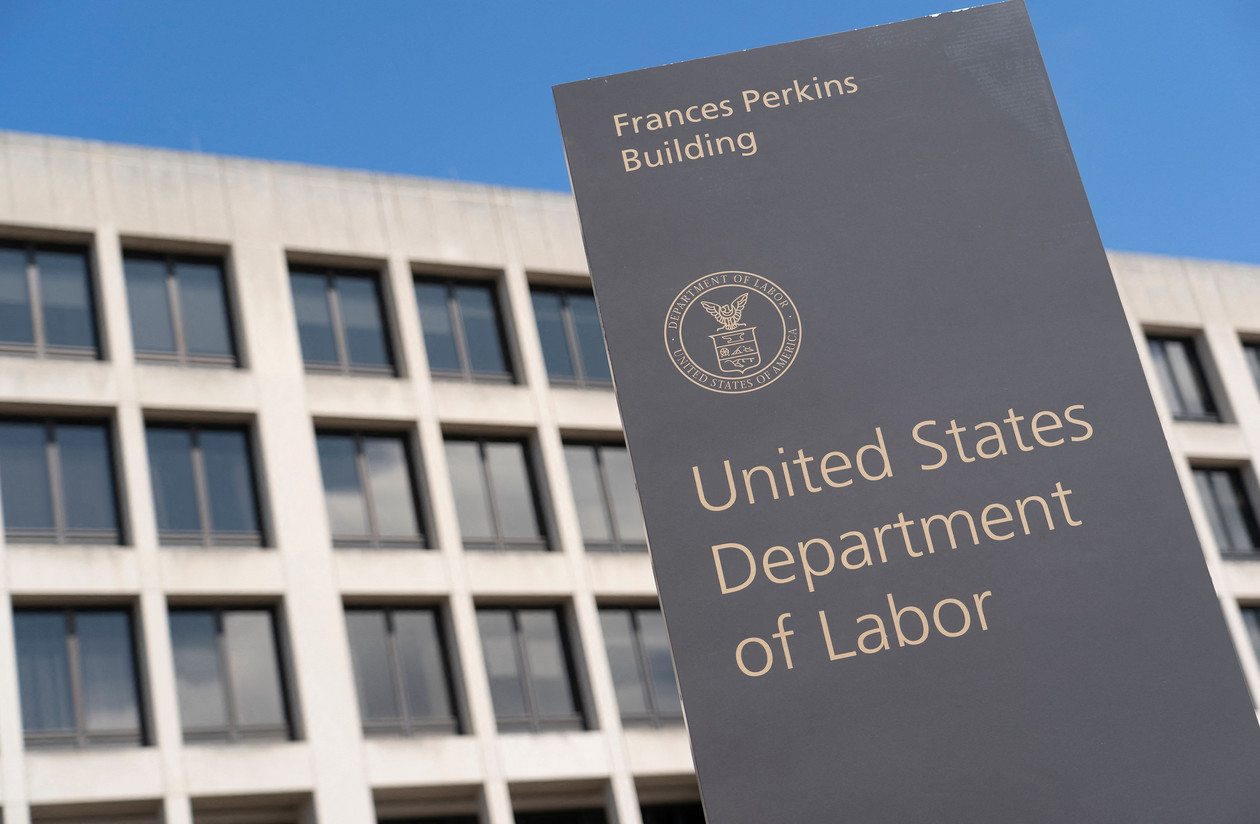

According to Friday’s report from the Labor Department, the unemployment rate reached 4.3% in July, the highest level since late 2021. The economy has been hit hard by rising costs, but the number represents a glimmer of hope following more than two years of unemployment below 4%.

Worryingly, data shows that the labor market is now contracting at a faster rate as high interest rates cut into expenditure and investment. This raises concerns about the possibility of a downturn in the United States, which was not a concern for economists a couple of months ago.

The Federal Reserve chose not to loosen monetary policy this week, despite inflation falling below 3%, which is terrible news for the economy and Vice President Kamala Harris, who is trying to rally support for her presidential campaign.

Sen. Elizabeth Warren (D-Mass.), who has been asking for rate cuts for months, said in a post on X that “Fed Chair [Jerome] Powell made a serious mistake not cutting interest rates.”. Waiting too long might send the economy plunging into a quagmire, as he has been repeatedly told.

“If we start to see something that looks to be more than that, then we’re well-positioned to respond,” Powell said on Wednesday, adding that the employment market has gone from overheated to more normal settings.

Even though it was slower than in prior months, the economy nonetheless managed to add 114,000 jobs last month.

Rising interest rates are starting to show their pressures. There has been a consistent decline in the amount of available jobs for the past two years. This past week, the number of people filing for unemployment benefits reached an 11-month high. Even though layoffs have remained low, fewer workers are quitting their jobs to seek employment elsewhere. Weak manufacturing and employment statistics sent stocks tumbling on Thursday, and after Friday’s employment report, they fell again.

Now, instead of the usual quarter-point decrease, investors are putting a lot of money on the central bank cutting its benchmark rate by half a percentage point in September.

With inflation having fallen sharply, the report reveals that employment is rising more slowly, according to President Joe Biden’s statement. Our investing in America strategy, which is providing well-paying employment to underserved communities, is a contributing factor to the continued strength of business investment.

A senior official in his department of labor predicted the weakening job market.

The Acting Labor Secretary, Julie Su, told Bloomberg that for a year they discussed how the figures were excessively high and hot, and that they had always intended to shift to a more sustainable and consistent speed of development.

The opportunity to accuse the administration of being responsible for the underwhelming report was quickly taken advantage of the Republicans.

In a statement, Jason Smith, the chair of the House Ways and Means Committee, characterized the jobs report as “one of the worst we have ever seen from the Biden-Harris Administration” due to the widespread job losses and signs of a recession.

Concerns about a recession will revolve around the Sahm rule, which was named after a former Federal Reserve economist. It states that a recession is imminent if the three-month average unemployment rate rises by half a percentage point from its lowest point in a year.

The economy enters that area with Friday’s employment data.

Sahm told AWN last week that this time could be different, but overall, it’s more of a statistical regularity than a sure prediction tool. (The rule is useful because it can foretell a recession even before other indicators are obvious.)

“We don’t know that we’re in a recession yet; there are reasons to doubt the Sahm rule, but this is a big jump and we’ve reached it,” said Diane Swonk, chief economist at KPMG. “The color red is flashing.”

“It’s ugly — the Fed has got to be feeling a little bit remorseful that they didn’t move and cut [rates] at their meeting in July,” Swonk quipped.

Government data showed GDP rose 2.8% in the second half of the year, which is far from a warning of a recession, according to data released last week.

“I am absolutely certain that we are not experiencing a recession,” Sahm declared. She went on to say that increased interest rates have put downward pressure on the economy, but that the labor market has protected it to some extent. A surge in the jobless rate might be attributable, in part, to more immigrants joining the labor field, which would be good for economic growth.

She did say, prior to the employment report, that “we’re heading in the wrong direction” on a more fundamental level. The rate of unemployment has been steadily increasing. It has been going up for more than a year.