There’s a consensus emerging that some tougher economic times are ahead of us.

The leader of the largest US bank sees not just a storm, but an economic “hurricane.”

“That hurricane is right out there down the road coming our way,” JPMorgan Chase CEO Jamie Dimon said Wednesday at a financial conference in New York.

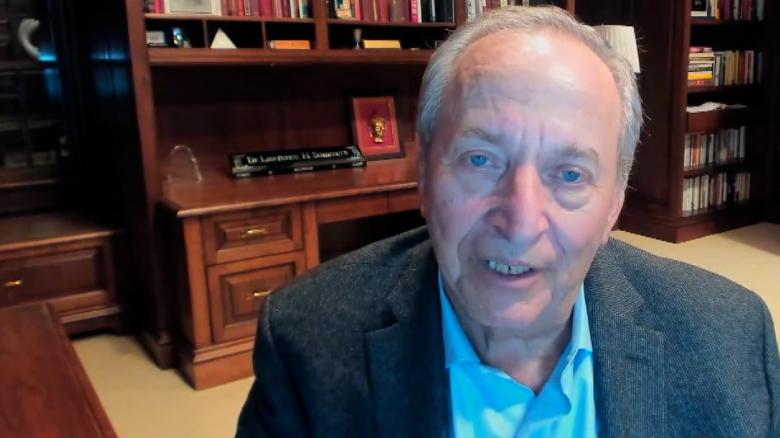

Larry Summers, a former treasury secretary and White House economic adviser under two Democratic presidents, told AWN “the unfortunate, painful fact” is that with such low unemployment and high inflation as the US is experiencing now, a recession is almost certain within the next two years.

For now, Americans are just going to have to get used to higher prices, according to President Joe Biden. “The idea we’re going to be able to click a switch, bring down the cost of gasoline, is not likely in the near term. Nor is it with regard to food,” Biden said at the White House on Wednesday.

Both Dimon and Summers couched their predictions.

“We just don’t know if it’s a minor one or Superstorm Sandy,” Dimon said, extending his hurricane analogy. But he added, “You better brace yourself.”

Summers said he doubts there will be anything on the order of the pandemic or the Great Recession anytime soon. Still, as AWN wrote earlier in May, most CEOs are preparing for a recession.

Economists, like everyone, are often wrong. Summers and Dimon were among the people warning last year that leaders at the Federal Reserve and Treasury Department were wrong about inflation.

The officials said that inflation, which is now at a 40-year high, would be temporary.

‘I was wrong’

That prediction of temporary inflation did not turn out to be the case, and Treasury Secretary Janet Yellen now readily admits it.

On Tuesday, when AWN’s Wolf Blitzer played a year-old clip for Yellen of her saying she didn’t anticipate inflation would be a problem, she owned it.

“Well, look, I think I was wrong then about the path that inflation would take,” she said.

Why was she wrong?

Yellen pointed to “unanticipated and large shocks to the economy that have boosted energy and food prices, and supply bottlenecks that have affected our economy badly that I didn’t — at the time — didn’t fully understand.”

Watch the full interview with Yellen.

The war in Ukraine had an effect on fuel and food prices.

Covid-19 variants continued to affect workers and snarl supply chains.

Who knows what unexpected thing will come next.

Now taking it seriously

Inflation is now the top priority at the White House, Biden said Tuesday, ahead of a meeting with Federal Reserve Chairman Jerome Powell and Yellen.

Gas prices hit a fresh record of $4.67 a gallon on Wednesday, confounding some experts who had thought prices might fall by now.

The start of the summer travel season and Europe moving to wean itself from Russian oil are just two of the many reasons they could keep rising, writes AWN’s Chris Isidore.

More rate hikes will be needed

Summers argued Wednesday that it’s almost guaranteed the Federal Reserve will have to raise interest rates much more than it has in order to control inflation. He said the Fed may have to keep raising rates even when the inflation feels under control.

“The temptation is always to stop the antibiotic as soon as you feel better,” Summers said, although that often “makes the problem come back later.”

The bright side

The inflation feels bad — just go to the grocery store or eat a meal out — but it’s still nowhere near the 1970s.

“Yes, inflation is a pain,” writes AWN’s Paul R. La Monica. “But the job market is still in good shape. The unemployment rate remains low and wages are still growing, admittedly not as quickly as prices. Supply chain constraints could finally begin to abate, which would relieve a lot of the pressure on prices.”

Job gains will slow

Yellen told Blitzer that the job gains will slow and now the goal is to preserve them.

Biden also warned in a Wall Street Journal op-ed published on Monday that employment gains will slow, but said that “will be a sign that we are successfully moving into the next phase of recovery,” not a cause for concern.

Getting out of the Fed’s way

Biden’s main answer to fighting inflation, he said before the meeting with Powell and Yellen, is to stay out of the Fed’s way and “respect the Fed’s independence,” presumably as it goes about the painful process of raising interest rates and controlling prices.

Former President Donald Trump, by contrast, routinely pressured the Fed to keep rates low.

Raising rates is most of what the Fed can do, although it is simultaneously reducing its balance sheet, an effort called “quantitative tightening.” Doing both things at the same time is an experiment in real time.

Summers suggested undoing corporate tax cuts pushed into law by Trump and the Republicans in 2017, although that would take time and more votes than Democrats currently have in the Senate.

The main thing, he said, is to confront inflation now and avoid larger problems down the road.

Summers said the rule of thumb is that interest rates can stop inflation when they go up more than inflation.

In other words, it could get much more expensive to borrow money in the coming years.

“I think that’s what we’ve got to keep in mind — what’s been necessary in the past to contain inflation,” he said.

He might be wrong, Summers cautioned, but be ready for it.