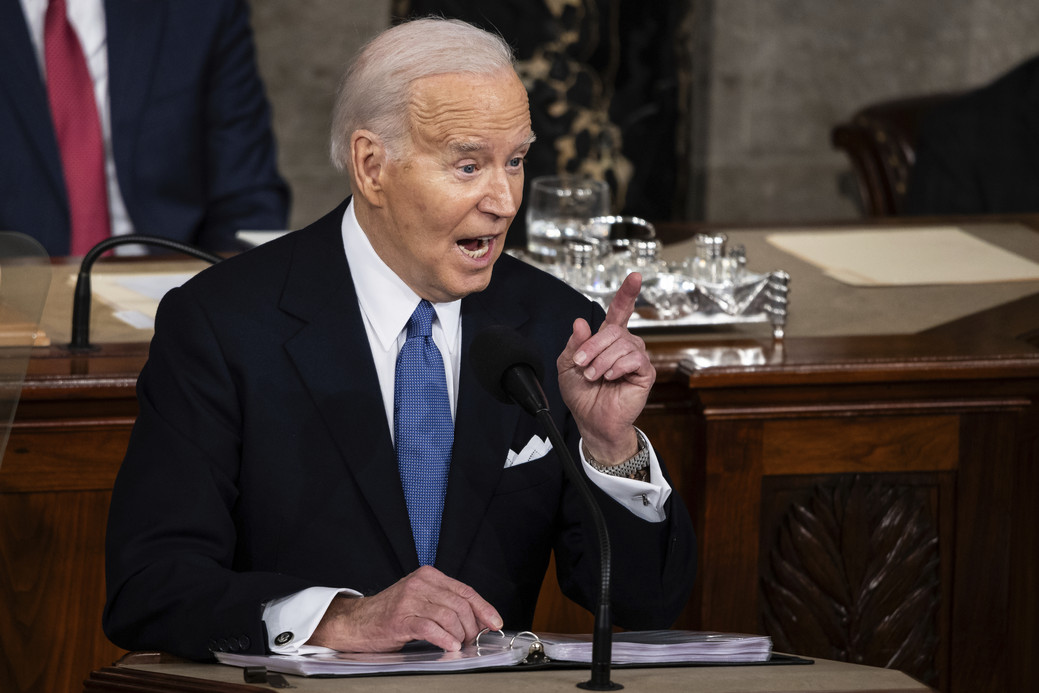

In a victory lap for his first term in office, President Joe Biden utilised his yearly budget proposal as a campaign brochure on Monday, naming Donald Trump.

Biden accused Trump and Republicans of “deliberately” concealing the cost of tax cuts they passed for corporations and the rich as he filed his annual budget request to Congress. The president has made it plain that he plans to base his reelection campaign on restoring economic growth after the COVID-19 pandemic, increasing expenditure on national security, reducing the cost of student loans, making housing and child care more affordable, and avoiding the Social Security cliff.

Before taking on Trump, the likely Republican presidential nominee, in November, Biden will have one final opportunity to highlight his spending and policy goals in the budget request. Given that people’ views of the present economy differ from Biden’s triumphal talking points, it’s a high-stakes sales pitch.

However, Biden’s most recent request for funding is much more of a vehicle for political rhetoric than his previous ones. Why? Because important federal spending decisions are expected to be postponed by Congress until after Election Day, even though the new fiscal year begins on Oct. 1, weeks before U.S. voters cast their presidential ballots.

The Republican criticism of Biden’s budget is overt, continuing with the political theme.

He attacked the Republican Party in seven different ways in his fiscal 2025 budget:

Medical Insurance and Social Security

Despite Biden’s earlier pledge to “stop” lawmakers from raising the retirement age for Social Security benefits in his State of the Union address, his budget proposes increasing taxes on high earners to prevent Social Security and Medicare from becoming bankrupt in the next ten years.

When taking into account both income and investments, those with annual incomes exceeding $400,000 would be subject to higher Medicare taxes than they already pay. They would see a 5% increase to their Medicare tax rate, from 3.8% now.

The president has made it clear in his budget address on Monday that he would oppose any attempt to reduce or undermine the Medicare or Social Security benefits that seniors and those with disabilities have worked hard to earn and pay for.

War over food

Administration officials claim that Republicans are determined on cutting essential programmes and benefits, however the president’s budget plan stands in stark contrast to their plans on food assistance for low-income families.

Full funding of the Women, Infants, and Children (WIC) programme for nutrition assistance would get $7.7 billion. That’s an increase of about $700 million over the budget that Congress approved last week.

Following GOP leaders’ opposition to a $1 billion boost for the WIC programme this month—demanding stricter restrictions on other food aid in return—Biden is requesting that increase.

In the event that WIC incurs unforeseen expenses, he is also advocating for an emergency fund to supplement their funding. Earlier this year, the assistance programme encountered a financing cliff as a result of increased enrollment and higher food prices.

Reductions in taxes

In his plan, the president criticises Republicans for the tax cuts that the Republicans pushed through in 2017, the package that he signed into law.

The budget accuses the former president and Republicans of hiding the debt rise caused by their policies, calling it “one of the most egregious and fiscally reckless budget decisions in modern history,” and states that Biden inherited a “fiscally irresponsible legacy.”

In 2017, a law was passed that reduced the corporate tax rate from 35% to 21%. In addition to doubling the corporate minimum tax from 15% to 21%, Biden’s proposal would bring it back up to 28%.

Tax cuts for those with incomes below $400,000 are preserved in Biden’s budget, as was his earlier pledge. Along with restoring a Child Tax Credit enhancement from the epidemic era, it seeks to reduce taxes for low- and middle-income Americans by $765 billion over a decade.

Assistance for Ukraine

Noting that Republicans in the House have not yet addressed the $95 billion national defence spending package that the Senate approved last month, the White House is restating its demand for emergency funds totaling tens of billions of dollars to be allocated to Ukraine, Israel, and Taiwan.

If House GOP leaders do not take action, the budget states, “life-saving assistance and development” for some of the “world’s most vulnerable areas” will be jeopardised, and the demands of the Ukrainian battlefield will also be negatively affected.

Debt from higher education

In spite of conservative-driven court challenges, the budget upholds a central promise of Biden’s reelection platform: the relief of millions of Americans from their college loans.

Also, Biden wants to raise the maximum amount a student can receive in a Pell Grant by $100 to make sure more people can afford to go to public or non-profit universities; he has proposed a $12 billion fund to do just that.

Costs of energy in rural areas

Achieving the objective of 100 percent clean electricity by 2035 is a priority for the Biden administration, and rural areas are highlighted as such in their budget.

Contrary to what House Republicans have been trying to achieve, this document highlights the administration’s attempts to increase financing for renewable energy in rural areas.

Minimising deficits

More than $1.6 trillion in discretionary funding is outlined in Biden’s budget for the upcoming fiscal year. The president and former Speaker Kevin McCarthy negotiated a debt deal last summer, which sets funding restrictions; however, conservatives in the House want a much lower number.

Simultaneously, the plan seeks to raise $3 trillion in tax revenue over ten years by, among other things, increasing the corporate tax rate, increasing penalties for fraud, and mandating that billionaires pay 25% of their income in taxes.

A Republican-led budget plan that seeks to cut the deficit by $14 trillion over a decade just made it out of committee. As for the economy, it depends on optimistic assumptions and both specific and generalised measures to reduce spending.

The president is very open and has laid out in great detail how he would demonstrate his love for the American people, according to White House budget director Shalanda Young, who spoke to reporters. “Republicans in Congress drew cover behind abstract concepts of balance in their speeches. Who are you harming while this is happening? Are you chopping something?

Budget Brawl: Biden’s Top Picks Lock Horns with Republicans in 7 Major Fights…