President Joe Biden has proposed a new plan to erase large portions of student loan debt for millions of borrowers. On Tuesday, the Education Department revealed a draft of this plan.

About 25 million Americans have accrued interest that exceeds the amount they borrowed, and his idea aims to cancel their debt. Two million borrowers who have been carrying their loans for decades would also benefit, as would another two million borrowers who were eligible for current federal programs but didn’t apply. There was hope for borrowers who had participated in “low-value programs” as well.

According to the administration, approximately 30 million borrowers would be eligible for the plan and its other initiatives to reduce student debt beginning this fall if they were to be put into action.

According to Education Undersecretary James Kvaal, “Borrowers struggling with their loans — and that’s a lot of people” are the target audience for these several types of debt relief. The interest on loans taken out by 25 million people is increasing at a rate that exceeds their ability to repay them. Just that one thing illustrates how desperately President Biden’s plan to reduce student loan debt is required.

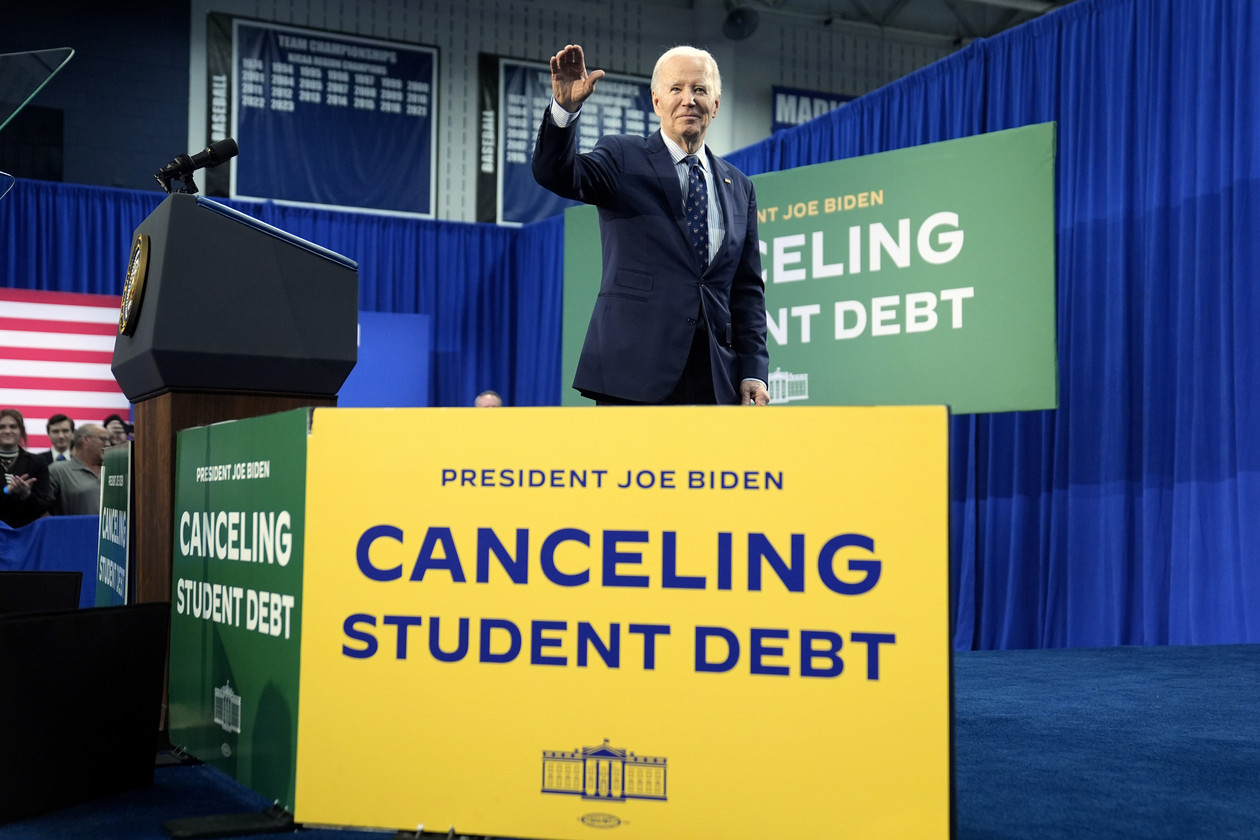

While other senior administration officials traveled to other swing states to bolster Biden’s argument, he initially unveiled the idea last week at a Madison, Wisconsin, community college.

Following last year’s Supreme Court rejection of his more comprehensive plan to cancel some student loan debt, Biden is attempting to fulfill his campaign pledge to do so with this plan, which offers targeted relief for the majority of students.

The president’s senior staff have previously expressed their “confident” belief that the court will find Biden’s fresh effort to be sufficiently unique to pass muster. Unlike the original plan, which was based on emergency powers linked to COVID-19, this proposal is dependent on the Education secretary’s legal authority under the Higher Education Act.

Rep. Virginia Foxx (R-N.C.), who heads the House education panel, condemned the plan as “reckless and fiscally irresponsible,” in contrast to the praise extended to the Biden administration’s initiatives by Democrats and debt relief advocacy groups.

“You have no legal ground to stand upon,” Foxx told the president. “There is no kindness or generosity in your plan. Every single kid, family, and hardworking taxpayer in this nation is ensnared in its total disdain.

Wednesday will see the publication of the proposed rule in the Federal Register, and comments will have 30 days to respond. The department has stated that it still hopes to complete its rules by the fall.

In the next months, another proposed rule will be prepared with an emphasis on helping borrowers who are going through tough times. Borrowers who are very likely to default or who “show hardship due to other indicators” (such as high medical and caregiving expenses) may have their loans automatically forgiven as part of these plans.

“Our Administration is working as quickly as possible to deliver relief to as many borrowers as possible,” a department official said regarding the hardship proposal, echoing President Biden’s remarks last week. “We are proceeding with these proposed rules today to ensure that borrowers can start receiving relief as soon as this fall, while we vigorously continue to develop the NPRM related to hardship for release in the coming months.”