Paul Ryan, the former speaker of the House, is not going to support or even hint that he will vote unwillingly for Trump, unlike the majority of Republicans who have been skeptical of Trump.

On Fox News this week, Ryan—a Republican who represented the swing state of Wisconsin in Congress—argued that Trump is “unfit” for office and vowed that he will replace Trump with another conservative Republican.

It was noteworthy because it happened on Fox News, a platform where critics of Trump are scarce. After leaving politics for good, Ryan continued his successful career on Wall Street and is now a board member of the conservative network’s parent firm.

Ryan announced his candidacy for the Republican Party, calling himself “an anti-establishment Republican at this time,” and stated his preference for a party grounded in values rather than populism or personality.

Ryan, the Republican nominee for vice president in 2012, is shockingly out of step with his party. Another Republican who has effectively joined the dwindling resistance to Trump is Sen. Mitt Romney, who was the 2012 Republican presidential contender and chose Ryan as his running mate.

The solemn vow to do nothing

Ryan says he has a specific reason to be concerned, but he shares the dissatisfaction of many Americans with neither major party candidate. Examining his key argument in greater detail is worthwhile.

“They’re both pledging not to address the debt,” Ryan remarked, returning to the matter that has driven his political agenda.

He made the comment, “All the First World countries have the same issue we have: baby boomers retiring and unfunded entitlements coming due and massive amount of debt,” in reference to Medicare and Social Security, the programs that offer quality of life to millions of aging Americans but also consume an increasing share of federal spending.

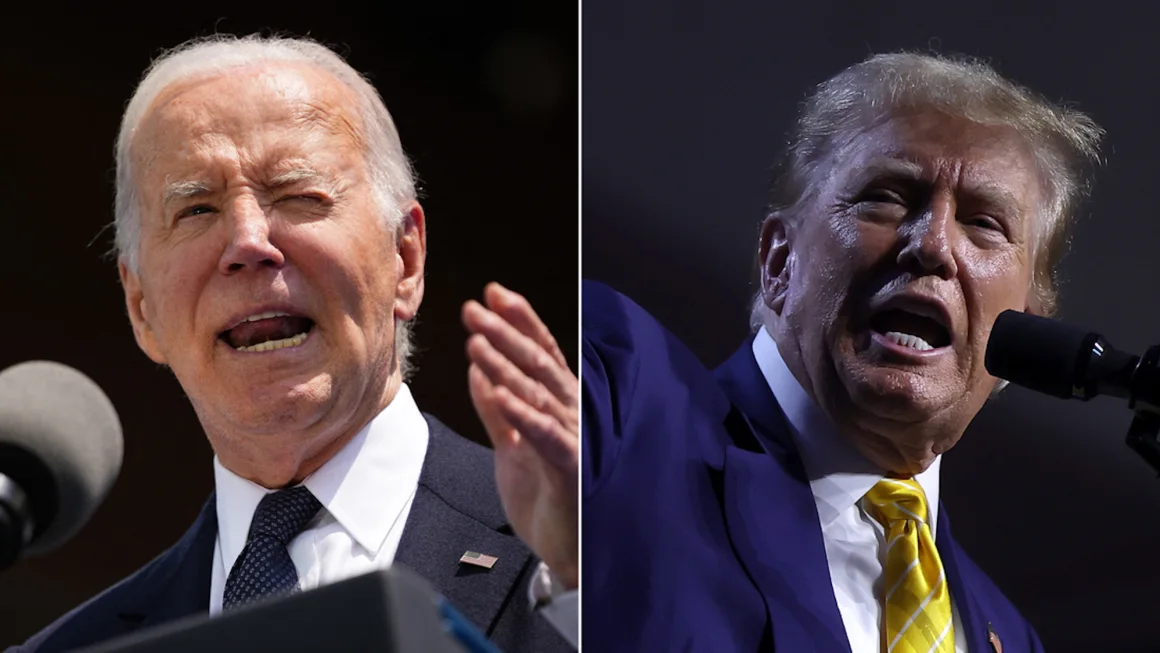

Joe Biden and Donald Trump, just so the record shows, have both pledged not to slash benefits. In March, Trump hinted in an interview that he could be willing to eliminate Medicare and Social Security. However, his campaign wasted little time in clarifying that he was referring to waste, not the programs themselves. When other Republicans in the Republican primaries were willing to consider changes to these programs, he attacked them.

Still going strong at $34 trillion

Both Democrats and Republicans have presided over a ballooning national debt that now surpasses $34 trillion. Partisans from both houses of Congress backed expenditures during the pandemic. During Trump’s presidency, Republicans significantly reduced taxes. While Obama was in office, Democrats enacted the Patient Protection and Affordable Care Act, and Biden oversaw the passage of the American Recovery and Reinvestment Act and the Inflation Reduction Act.

At least among presidents, Ryan is entirely correct in saying that addressing the debt is not a top political priority.

“With the political will, you can fix it,” Ryan stated. At this time, we lack the political will to do it. The political climate is light at the moment.

Policy experts and economists are deeply divided about whether or not the United States should be worried about its mounting debt, but they can all agree that the country is heading in an unsustainable direction.

We should prioritize tax reduction.

In the broader political discourse, however, the question of whether or not to prolong the tax cuts enacted under Trump’s administration is receiving greater attention. The conflicting pledges made by Biden and Trump are examined by AWN’s Tami Luhby.

Without matching expenditure cuts, Trump’s plan to extend all tax cuts threatens to further inflate the debt.

But Biden wants to make sure that only people with incomes of $400,000 or more are allowed the cuts to expire. The corporation tax rate, which is currently at 21%, will be raised to 28% by him. The current tax structure was enacted by Republicans under Trump and made temporary, however most of the corporation tax cuts were left permanent.

Additionally, Democrats intend to raise social safety net spending via the tax discussion.

Additional information from Luhby: Biden and a few Democratic lawmakers view the impending conflict as a chance to reinstate or prolong additional beloved but costly tax provisions, such as the enhanced child tax credit, which was implemented for only 2021, and the more generous Obamacare premium subsidies, which are set to expire at the conclusion of next year. These two provisions were included in the American Rescue Plan Act, which was swiftly passed by Congress by Democratic lawmakers following Biden’s inauguration in 2021.

If you want to know more about the impending tax consequences, her story (which you can read here) lays out the case for and against the success (or failure) of the Trump tax cuts.

The fact that the national debt has increased by trillions of dollars under Trump’s and Biden’s administrations is an inarguable fact.

Afraid about “extreme budget cuts”

If the Treasury Department is unable to sell the interest-bearing bonds that finance deficit spending, Ryan says the government would have to print more money to pay for it.

When it happens, a dollar crisis ensues. When that happens, people start to doubt the dollar’s status as the global reserve currency. To escape the crisis, he warned, “That’s a huge privilege we could lose,” stating that doing so would necessitate “radical budget surgery”—meaning, severe and painful sacrifices.

Fixing it now will be easier than fixing it later, he says, but either way, it needs fixing.